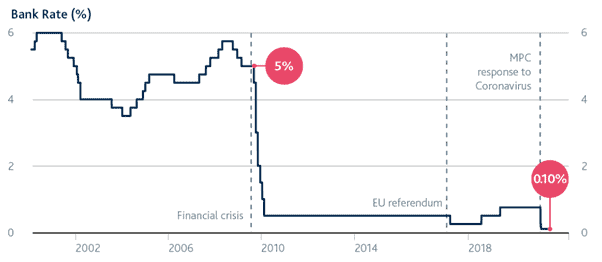

Ever since the 2008 financial crisis, being a saver has been tough. Interest rates, already historically low, have taken another hit this year as the coronavirus pandemic rocked the UK economy.

The Bank of England reduced interest rates twice in March. The Base rate dropped first to 0.25% and now sits at just 0.1%.

Source: Bank of England

Although assets held in cash can be useful as an emergency fund – it’s easy to access and protected by the Financial Services Compensation Scheme (FSCS) – you won’t be seeing much return on your savings.

If you’re relying on cash to help fund your goals for later life and in retirement, it might be time to consider moving your savings into investments.

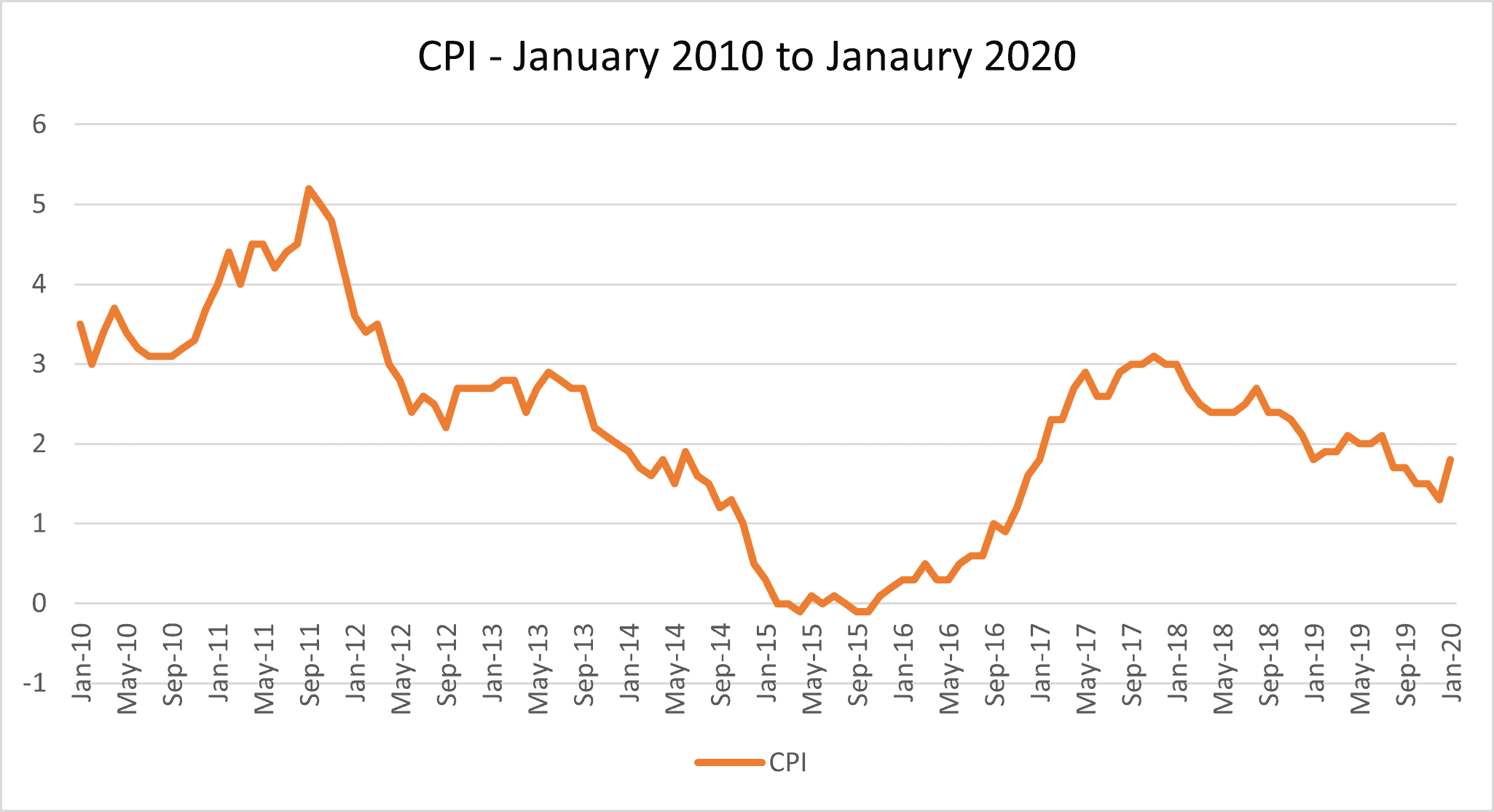

Inflation means that savings in low interest accounts could lose value in real terms

Low interest rates mean that you won’t see much return on your savings each year. That might be disappointing, but the real issue – that of inflation – is far more serious.

Where your savings have an interest rate in line with inflation, the value of your money effectively stays the same.

When rates are low, as they have been for the last decade, inflation can outpace the Bank of England Base rate. The spending power of your savings decreases. To put it another way, your savings lose value in real terms.

Source: ONS

Compare the two tables. The Consumer Prices Index (CPI) has largely been ahead of the Bank of England Base rate over the last decade. Using the Bank of England’s inflation calculator you can see the effect of this over the long term.

If you had £20,000 in savings in 2010, for your funds to have the same buying power in 2019, you’d need an additional £5,837.40. With rates low, it is unlikely your savings will have returned anywhere near that amount.

The difference has been effectively lost.

Investing could provide better returns… but with increased risk

Investing won’t be right for everyone, and there are several important factors to consider. Speak to us and we can help decide if it is right for you.

Firstly, investing is a long-term prospect. If you anticipate needing to access your money within the next five years, investing might not be right for you. You’ll also have to have a very clear understanding of your attitude to risk.

Understanding your investment aims will help you think about the risk you’re willing to take. Ask yourself these three questions:

- What is my capacity for loss? – Your investment might go down in value, so think about what that means for you, and anyone financially dependent on you.

- What is the time frame and purpose of my investment? – If you’re investing for retirement and it’s still a long way off, you might take more risk. If you’re saving for a newborn child’s education, on the other hand, the shorter time frame and ultimate aim might make you more risk-averse.

- Am I generally cautious, or a risk-taker? – Your attitude to risk isn’t a static thing. Your personal circumstances and the state of the market at the moment when you invest could play a part.

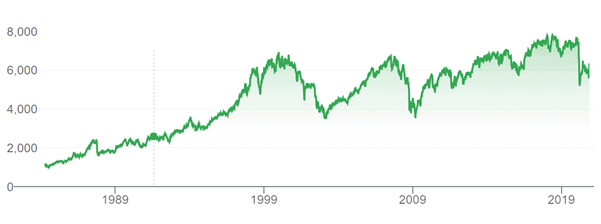

The FTSE 100 since 1984

Remember that you’ll also need to be comfortable riding out short-term volatility in the market, such as we saw at the start of the year.

The general trend of the markets is an upward one, but you need to be invested to reap the rewards of that trend. That means holding your nerve and remaining patient when dips in the market occur.

Consider a Stocks and Shares ISA… or put money into your pension

If you’ve decided to move some of your savings into investments, you’ll still have important decisions to make about the type of product you choose.

- Stocks and Shares ISA

You might consider a Stocks and Shares ISA. The money you place into these ISAs will be invested in the stock market with the potential to outstrip inflation. They’re a great way to begin investing, and they are also tax-efficient.

Any gains you make on investments in a Stocks and Shares ISA are free of both Income Tax and Capital Gains Tax (CGT). There is an ISA Allowance though, capping the subscriptions you can make into an ISA at £20,000 a year.

Open to all UK residents over the age of 18, you can invest in a range of funds to match your risk profile.

- Pension

If you have an emergency fund set aside, you might consider using any other disposable income to top up your retirement fund.

Pension contributions attract tax relief up to your Annual Allowance. The Annual Allowance is £40,000 a year for the 2020/21 tax year, but other Allowances might apply if you are a high earner or have already accessed some retirement benefits. Speak to us if you are unsure of your allowance.

Before significantly increasing pension contributions, you’ll need to think about how far off your retirement is and what other sources of retirement income you have.

Get in touch

Savings held in cash are great as an emergency fund, but with interest low, the devaluing effects of inflation shouldn’t be ignored. Whether you’re new to investing or looking to expand or rebalance your portfolio, get in touch. Please email hello@fingerprintfp.co.uk or call 03452 100 100.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Your pension income could also be affected by the interest rates at the time you take your benefits. Levels, bases of and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor.