The Independent Schools Council (ISC) reports that there are more than half a million children in private education in the UK. There are also more than two million students in higher education.

Average annual private school fees currently stand at £15,000 a year, and course fees for an undergraduate degree at an English university are capped at £9,250 a year. It pays to start saving for your child’s schooling early.

Here are five ways to save effectively for your child’s education, but first, a closer look at the numbers.

The cost of private education is high

On average, sending your child to a private school will cost £15,000 a year. But fees vary greatly between day and boarding schools.

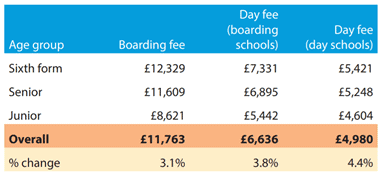

As you can see, the average price per term for a boarder is more than double the cost of a day school, nearly £5,000 for a day school rising to around £11,700 for boarding schools.

Source: ISC Census 2020

Notes: School fees exclude nursery fees. Figures represent average weighted fees per term. Average fee figures are based on fees at schools completing the Census in 2020; percentage change is calculated from the change among the 1,339 schools completing the Census in both 2019 and 2020

You’ll also find that fees can vary significantly across geographical areas.

According to the ISC, average fees range from around £3,700 per term for day schools in the North West to just short of £6,000 in London.

Undergraduate course fees in England are capped at £9,500

The annual cost of undergraduate courses in English universities is capped at £9,500. But with courses typically lasting three years, fees alone could amount to £28,500. They’ll be plenty of other expenses too.

According to Times Higher Education, average student rent in 2020 came to £547 a month, outside of London. This figure rose to £640 a month in the capital. The average annual cost of accommodation based on a 39-week contract is nearly £5,000 – around £14,700 for a three-year course.

A maintenance loan could partially cover the cost of things like accommodation, food, and books. The loans are partly means-tested but your child could receive between £3,410 and £12,010 if eligible.

There are some effective steps you can take to save for your child’s future

1. Start early

Whichever educational route you choose for your child, you’ll want to start putting money aside as soon as possible.

Investing is a long-term prospect – our recommended minimum investment period is five years – so starting early is key. Taking out an investment product as soon as your child is born gives you more time to contribute and also enables you to take advantage of the effects of compounding.

2. Make the most of compounding

Compounding means not just making interest on your returns, but on the growth on those returns too. As an example, say you put £5,000 into a savings account with an annual interest rate of 2.5%. You’d earn £125 interest in the first full year.

In the second year, the annual interest rate remains the same, but the amount of interest you earn would increase (as long as you leave your £5,125 in the same savings account). This is because 2.5% of £5,125 is £128.13.

That might seem like a small jump in interest, but the effects of compounding become significantly more pronounced over time, and as amounts grow higher.

The sooner you start taking advantage of the effects of compounding, the bigger growth you’ll see.

3. Take out a Stocks and Shares Junior ISA or a fixed rate bond

We recently revealed how to make your grandchild a millionaire. Step one was to set-up a Junior ISA (JISA) on their behalf. A Stocks and Shares JISA is a fantastic way to start saving for your child’s future.

Back in March, Chancellor Rishi Sunak more than doubled the JISA Allowance. That’s the amount you can pay into a JISA on your child’s behalf each year. It now stands at £9,000 and any profits accrued are free from tax. If you opt for a JISA, be sure to maximise the £9,000 allowance each year.

A JISA is not the only savings and investment product you might opt for though.

If you have a large sum to invest, consider opening a long-term fixed-rate bond but be sure to shop around for the best rate, or speak to us.

4. Extended family gifting

If you’re looking to send your child to a private school from an early age, you might not have the time to allow your investment to grow. You might look for help from your child’s grandparents.

HMRC rules allow some gifts to be made in a tax-efficient way.

A grandparent can gift a lump sum to help towards school fees and provided they live for a further seven years after making the gift, it will not be included in the value of their estate for Inheritance Tax (IHT) calculation purposes.

A grandparent can also make use of their £3,000 annual exemption. A child with four grandparents willing to help pay towards their education could receive £12,000 a year toward school fees. These amounts won’t be liable to IHT, even if a grandparent died within seven years of making the gift.

Grandparents can also make use of the regular gifts out of income exemption. A grandparent can contribute to a JISA or investment set up on their grandchild’s behalf, tax-free, if it can be proven that the gift is regular and that it does not detrimentally impact their normal standard of living.

5. Speak to us

Whether you are looking to fund a private education or a university degree, we can help you put a plan in place to afford it.

Starting early will give you the best chance of raising the funds necessary without affecting your standard of living, but whatever age your child, we can take a holistic view of your finances and work out where the money will come from.

Get in touch

To discuss building a fund to help pay for your child’s education, get in touch. Please email hello@fingerprintfp.co.uk or call 03452 100 100.