Last week was Pension Awareness Week.

The event is a national drive to get people thinking about their retirement savings and their goals for life after work. It incorporates webinars, one-to-one sessions, and a pensions roadshow that this year travelled from Edinburgh to Weston-Super-Mare.

The pensions you hold will likely comprise a large part of your income in retirement. The amount you save will therefore have a huge bearing on when you can retire, the sort of lifestyle you can afford to live in retirement, and whether you can retire at all.

In honour of Pension Awareness Week, here’s your guide to making the most of your pension savings.

1. Join your company pension scheme

Since 2012, companies have been obliged to provide a pension scheme for their employees, and to make contributions on your behalf. This is known as auto-enrolment.

If you are a member of your workplace scheme, you’ll be contributing a minimum of 8% of your qualifying earnings. Your employer must contribute a minimum of 3% on your behalf, which means you have to 5% pay.

You will also receive tax relief on your contributions. This is an additional sum from the government, based on the rate of Income Tax you pay. If you’re a basic rate taxpayer, for every £100 you contribute, you’ll receive another £20.

If you’re a higher or additional rate taxpayer, you receive basic rate tax relief on contributions but can claim back additional tax relief through your annual tax return.

The Pensions Regulator states that between 2012 and April 2018, auto-enrolment saw ‘the proportion of eligible staff saving into a workplace pension increase from 55% to 87%.’

But is the contribution you’re paying enough to guarantee the retirement lifestyle you want?

2. Maximise your contributions

It’s never too early to start saving for your retirement. If you are already saving, are you saving enough?

Consider increasing your contributions if you can. An effective way to pay in more without missing the money too much is to wait until your annual pay review. As your salary goes up, put some or all the extra money aside.

Small increases in your pension contributions can have a massive impact over the life of the policy. The longer you invest money, the more chance it has to grow in value, and the greater the chance of better investment growth.

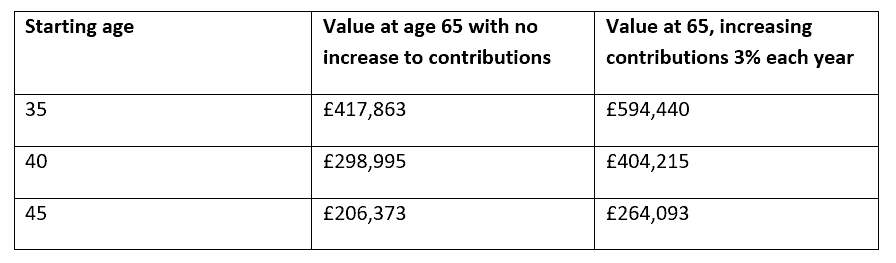

This table shows the value of a £500 per month investment over different terms to age 65, assuming 5% investment growth each year. It also shows the potential retirement fund if your annual contributions increased by just 3% each year.

Source: Calculatorsite.com

As you can see, a delay of even five years in starting contributions can have a massive impact on the final fund.

In this example, five years’ worth of contributions is £30,000. Starting at age 35 compared to 40 could mean a drop of around £118,000 in fund value at age 65. This value increases to £190,000 if your contributions increase by 3% each year.

Starting contributions at 35 and then increasing them 3% each year could increase your final pot at 65 by more than £176,000.

3. Be sure you have the right investment strategy

Different investments carry different levels of risk. Choosing the right type of investment, aligned to your aspirations and risk profile, can be crucial to the success of your pension fund.

The higher the risk, the greater the potential for large investment returns. Elevated risk also means a higher chance of sudden short-term losses.

Generally, if you’re still a long way from retirement, you might consider investing based on growth potential. Over the long-term, higher-risk investments should deliver higher returns.

As you get closer to retirement, a sudden drop in value – such as the markets saw earlier this year –could have a greater impact on your plans to retire.

Whereas a long-term investment gives your fund time to recover from a short-term blip, as you near retirement you’ll lose the luxury of waiting for the markets to improve. For this reason, you might consider moving some or even all your fund to lower-risk investments at this point.

Investing can be complex. If you aren’t sure about any aspect of your risk profile or the right investment strategy for you, speak to us.

4. Consider consolidating your different pension arrangements

The Telegraph recently reported that more than a third of professionals are expected to have at least ten jobs in their lifetime, which could amount to as many as 11 workplace pensions, with private pensions besides.

Keeping track of so many schemes can be difficult, and you might consider consolidation – rolling your small pension pots into one.

You’ll only have one statement to request, one value to keep track of, and you might even be able to reduce the charges you pay.

As well as potentially higher charges, older pensions might also be less flexible, with fewer fund choices and little control for you. Newer plans could offer online portals or the ability to switch funds and make changes in real-time.

You’ll need to be sure you aren’t giving up valuable benefits such as a guaranteed income at retirement. It won’t be right for everyone so speak to us if you’re considering consolidation.

5. Regularly review your pension

You should review your pensions at least annually. It’s important to check things are on track and that your investment profile still matches your plans and aspirations.

Retirement planning can be a complicated process, and financial advice can be crucial to make sure you’re getting the best value out of your pension arrangements.

Getting advice can also add actual value to your fund. Research from the International Longevity Centre has suggested that the value of financial advice could equate to £47,000 over a decade.

They will also be able to help you with the different taxation implications associated with pensions, so you benefit from the tax advantages and avoid any unnecessary tax charges.

Get in touch

Here at Fingerprint, we are pension specialists. We can help you review your current circumstances and help you plan for retirement, making sure you have the right arrangements in place.

If you feel you would benefit from our professional, expert retirement planning advice, please get in touch. Email hello@fingerprintfp.co.uk or call us on 0345 210 0100.

Please note:

A pension is a long-term investment. The value of your investment can go down, as well as up, and you may not get back the full amount you invested.

Levels, bases of, and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor.

The tax implications of pension withdrawals will be based on your individual circumstances, tax legislation, and regulation which are subject to change in the future. Your pension income could also be affected by the interest rates at the time you take your benefits.

Workplace pensions are regulated by The Pension Regulator.